Property Taxes In Texas Compared To California . Consistent with this, property taxes as a. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. Web the higher property tax revenues in texas are therefore driven by higher rates. California has an average property tax rate of 0.66%. Despite its ranking as the 3rd most expensive state to live in, california’s effective property tax rate of. A california property owner pays an. Web the property taxes in california are much lower than in texas and even lower than the national average. Web does california or texas have lower property taxes? Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only.

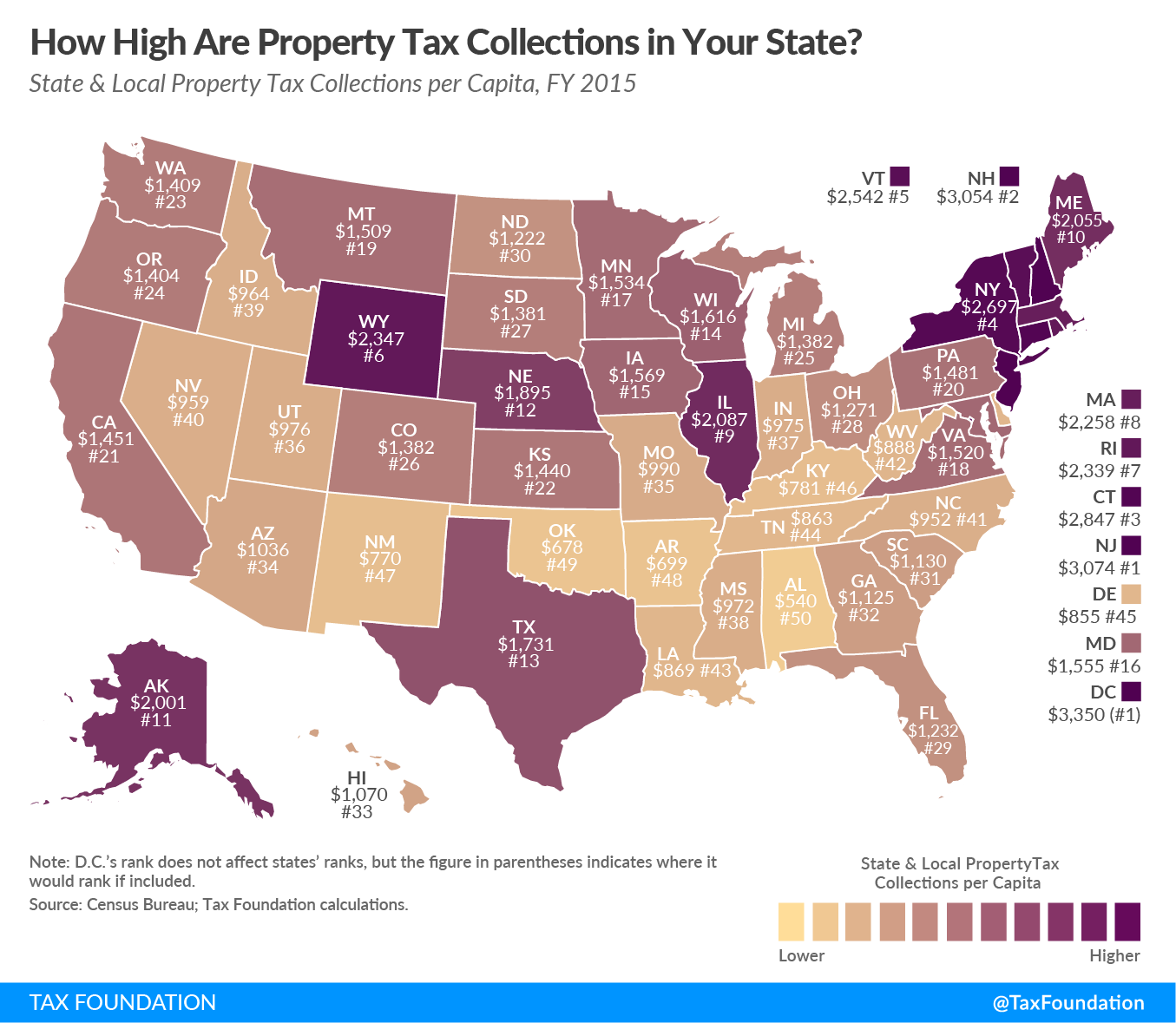

from taxfoundation.org

A california property owner pays an. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Despite its ranking as the 3rd most expensive state to live in, california’s effective property tax rate of. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Consistent with this, property taxes as a. Web does california or texas have lower property taxes? Web the higher property tax revenues in texas are therefore driven by higher rates. California has an average property tax rate of 0.66%. Web if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. Web the property taxes in california are much lower than in texas and even lower than the national average.

How High Are Property Tax Collections in Your State? Tax Foundation

Property Taxes In Texas Compared To California Despite its ranking as the 3rd most expensive state to live in, california’s effective property tax rate of. A california property owner pays an. Web the property taxes in california are much lower than in texas and even lower than the national average. Web if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. Despite its ranking as the 3rd most expensive state to live in, california’s effective property tax rate of. Consistent with this, property taxes as a. California has an average property tax rate of 0.66%. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web does california or texas have lower property taxes? Web the higher property tax revenues in texas are therefore driven by higher rates. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only.

From taxfoundation.org

Best & Worst State Property Tax Codes Tax Foundation Property Taxes In Texas Compared To California Despite its ranking as the 3rd most expensive state to live in, california’s effective property tax rate of. Web the higher property tax revenues in texas are therefore driven by higher rates. Web the property taxes in california are much lower than in texas and even lower than the national average. Web does california or texas have lower property taxes?. Property Taxes In Texas Compared To California.

From www.zillow.com

The Highest and Lowest Property Taxes in Texas Property Taxes In Texas Compared To California Web does california or texas have lower property taxes? Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web the higher property tax revenues in texas are therefore driven by higher rates. A california property owner pays an. Web if you are considering a real estate search,. Property Taxes In Texas Compared To California.

From lao.ca.gov

Understanding California’s Property Taxes Property Taxes In Texas Compared To California Web the higher property tax revenues in texas are therefore driven by higher rates. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web does california or texas have lower property taxes? Web the property taxes in california are much lower than in texas and even lower. Property Taxes In Texas Compared To California.

From mungfali.com

Historical Chart Of Tax Rates Property Taxes In Texas Compared To California Web the property taxes in california are much lower than in texas and even lower than the national average. California has an average property tax rate of 0.66%. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web does california or texas have lower property taxes? Web. Property Taxes In Texas Compared To California.

From shalnawlinda.pages.dev

California State Tax Brackets 2024 Estele Tamarah Property Taxes In Texas Compared To California California has an average property tax rate of 0.66%. Web if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. A california property owner pays an. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Web the. Property Taxes In Texas Compared To California.

From texasscorecard.com

Where Does Texas Rank on Property Taxes? Texas Scorecard Property Taxes In Texas Compared To California California has an average property tax rate of 0.66%. Web the property taxes in california are much lower than in texas and even lower than the national average. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Despite its ranking as the 3rd most expensive state to live in, california’s effective. Property Taxes In Texas Compared To California.

From omaha.com

The cities with the highest (and lowest) property taxes Property Taxes In Texas Compared To California Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. A california property owner pays an. Web the property taxes in california are much lower than in texas and even lower than the national average. Web does california or texas have lower property taxes? Despite its ranking as the 3rd most expensive. Property Taxes In Texas Compared To California.

From itep.org

California Who Pays? 6th Edition ITEP Property Taxes In Texas Compared To California Web the property taxes in california are much lower than in texas and even lower than the national average. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Web does california or texas have lower property taxes? A california property owner pays an. Web if you are considering a real estate. Property Taxes In Texas Compared To California.

From activerain.com

San Antonio Property Taxes Going Up in 2016 Property Taxes In Texas Compared To California Consistent with this, property taxes as a. California has an average property tax rate of 0.66%. Despite its ranking as the 3rd most expensive state to live in, california’s effective property tax rate of. Web the property taxes in california are much lower than in texas and even lower than the national average. Web wallethub estimates sales & excise taxes. Property Taxes In Texas Compared To California.

From www.forbes.com

On Property Taxes And Local Government Spending, Texas Already Is Property Taxes In Texas Compared To California Web if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Despite its ranking as the 3rd most expensive state to live in, california’s. Property Taxes In Texas Compared To California.

From taxwalls.blogspot.com

How Much Money Is Taken Out For Taxes In Texas Tax Walls Property Taxes In Texas Compared To California Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. A california property owner pays an. Web does california or texas have lower property taxes? California has an average property tax rate of 0.66%. Web the property taxes in california are much lower than in texas and even lower than the national. Property Taxes In Texas Compared To California.

From camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy Property Taxes In Texas Compared To California Web the higher property tax revenues in texas are therefore driven by higher rates. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Despite its ranking as the 3rd. Property Taxes In Texas Compared To California.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Taxes In Texas Compared To California Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. A california property owner pays an. Web does california or texas have lower property taxes? Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. California has an average property. Property Taxes In Texas Compared To California.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Property Taxes In Texas Compared To California Web the higher property tax revenues in texas are therefore driven by higher rates. Web the property taxes in california are much lower than in texas and even lower than the national average. Consistent with this, property taxes as a. A california property owner pays an. Web the difference in property taxes is one of the most important factors in. Property Taxes In Texas Compared To California.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Taxes In Texas Compared To California California has an average property tax rate of 0.66%. Web does california or texas have lower property taxes? Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Despite its. Property Taxes In Texas Compared To California.

From txcip.org

Texas Counties Total Taxable Value for County Property Tax Purposes Property Taxes In Texas Compared To California Web the property taxes in california are much lower than in texas and even lower than the national average. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Web the higher property tax revenues in texas are therefore driven by higher rates. Web if you are considering. Property Taxes In Texas Compared To California.

From www.youtube.com

Texas Property Taxes Explained Texas Property Taxes vs California Property Taxes In Texas Compared To California Despite its ranking as the 3rd most expensive state to live in, california’s effective property tax rate of. Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Web if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership. Property Taxes In Texas Compared To California.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Taxes In Texas Compared To California California has an average property tax rate of 0.66%. Web does california or texas have lower property taxes? Web wallethub estimates sales & excise taxes of $4591 for the theoretical median household in texas versus only. Web the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of. Consistent with. Property Taxes In Texas Compared To California.